25

Aug 2022

How to use a Mutual Fund Systematic Investment Plan (SIP) to get Your Mortgage interest back

What is home loan and Equated Monthly Installment (EMI)?

The monthly installment made by a borrower to a lender at a designated time is known as an Equated Monthly Installment (EMI).

The following are the variables that impact an Equated Monthly Installment (EMI):

Principal Borrowed: The principal borrowed refers to the entire amount of loans taken by the borrower.

Interest rate: This is the interest rate applied to the amount borrowed.

Tenure of the loan: The length of the loan, or its tenure, is determined by the borrower and the lender.

Floating or fixed rate loans: The “Rest” component has an impact on the Equated Monthly Installment (EMI) if the interest rate is variable.

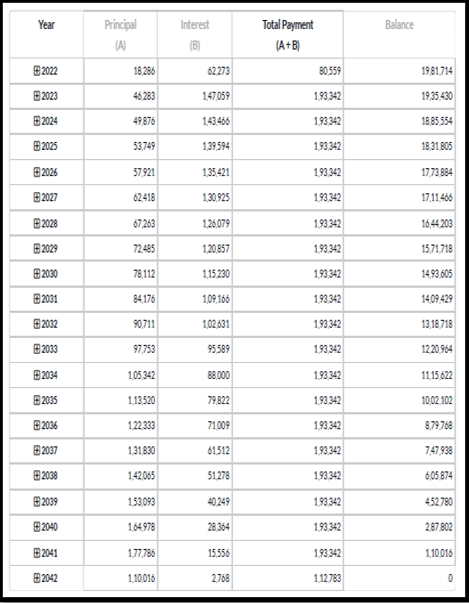

The amortisation schedule is a detailed table that includes all loan information as well as the breakdown of Equated Monthly Installment (EMI). It displays the percentage of each Equated Monthly Installment (EMI) payment that is allocated to principle and interest until the loan is repaid. The amortisation schedule, which contains information like the following, can help you understand how your loan develops during the loan term. Principal borrowed plus Equated Monthly Installment (EMI)

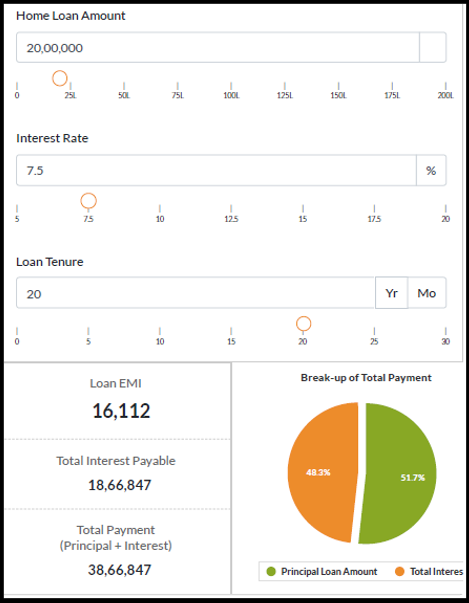

Cost of interest for each Equated Monthly Installment (EMI) payment. Home loans are one-time, lump-sum payments that you must make over the course of two or more decades. A loan for Rs. 20,000,00 at a 7.5% interest rate for 20 years will thus result in a total interest payment of Rs. 18,66,847.00 and Equated Monthly Installments (EMI) of Rs. 16,112.00. In this case, the total payment (principal plus interest) is Rs. 38,66,847.

HOME LOANS CALCULATION

Illustration No. 1: Calculation of EMI.

Illustration No. 2: Yearly Breakup of Principal + Interest Amount.

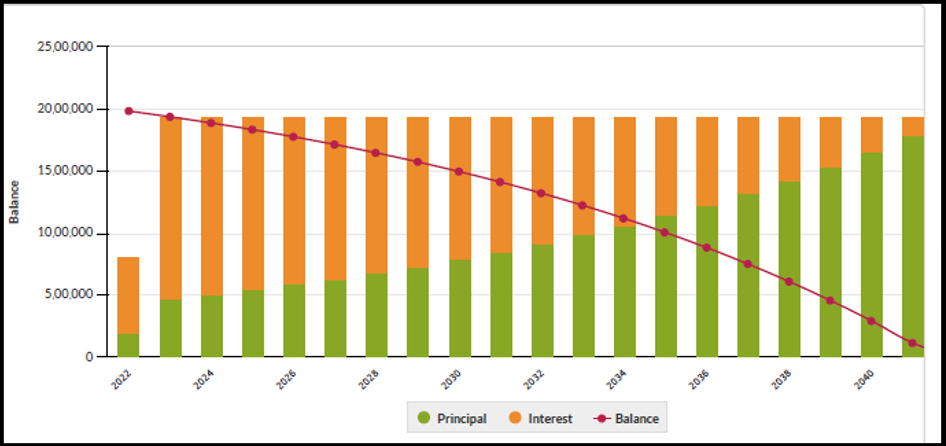

Illustration No. 3: Consolidated Principal + Interest of illustration No. 2.

What is Systematic Investment Plan (SIP)?

Both discipline and an awareness of market nuances are necessary for investing. However, factors like volatility and market timing might have an impact on your ability to make money. By investing through Systematic Investment Plans in a mutual fund of your choosing, you may have the best of both worlds.

Systematic Investment Plan (SIP) is a generally accepted investing method that let investors deposit a predetermined sum for a specified period of time. Similar to recurrent deposits, Systematic Investment Plan (SIP) take regular monthly investments with the option of providing standing withdrawal orders. Systematic Investment Plan (SIP) investing in mutual funds enable the removal of the risks associated with lump sum investments. It encourages financial discipline regardless of market changes.

The benefits of frequent Systematic Investment Plan (SIP) investing and long-term investing are boosted by the compounding effect. The compounding effect makes sure that you get returns on both your principal (the amount you actually invested) and the gains on your principal, so that your money grows over time as your investments generate returns. Also, the returns generate more returns.

How Can Systematic Investment Plan (SIP) Reduce the Stress of Mortgage Loans?

Home loan amount is simply repaid using mutual fund Systematic Investment Plan (SIP) investments. However, investing in a basket of equities spreads out the risks, unlike buying in riskier components like shares and stocks. A loan for Rs. 20,000,00 at a 7.5% interest rate for 20 years will thus result in a total interest payment of Rs. 18,66,847.00 and Equated Monthly Installments (EMI) of Rs. 16,112.00. In this case, the total payment (principal plus interest) is Rs. 38,66,847.

However, investing in mutual or index funds via Systematic Investment Plan (SIP) at the start of the house loan payback term can assist in recovering nearly the whole amount of the loan.

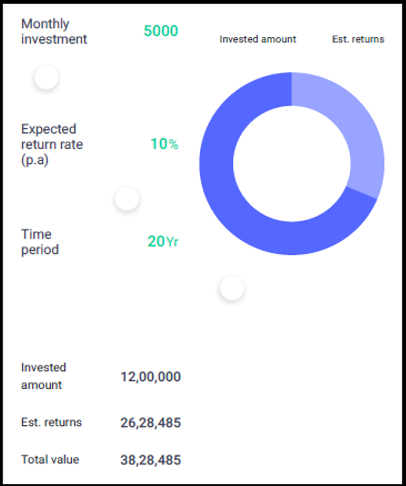

SYSTEMATIC INVESTMENT PLAN (SIP) CALCULATION

Illustration No. 4: Calculation of SIP.

As per above illustration, if investment is done in Systematic Investment Plan (SIP) of Rs. 5,000/- for 20 years with expected return (p.a.) of 10%, then the investment amount is Rs. 12,00,000/- in 20 years and estimated return is Rs. 26,28,485/-. So total return from Systematic Investment Plan (SIP) would be Rs. 38,28,485/-.

By looking at the example above a Systematic Investment Plan (SIP) yields approximately the same amount of total payment of loan in approximately the same time frame.

Hence the borrower’s money and risk management skills will help to achieve the financial goals.

Dr. Rahul Sanghavi

Head: Entrepreneurship Development Cell

IQAC Coordinator

For more information in our other Managment Courses, visit the following course details: